Snowflake (NYSE: SNOW) stock made big gains in Friday’s trading. The data technology company’s share price ended the daily session up 9.4%, according to data from S&P Global Market Intelligence.

While there wasn’t any company-specific news driving Snowflake higher today, the company’s valuation benefited from strong earnings results published by leading cloud services providers. In particular, Amazon’s better-than-expected fourth-quarter results helped give Snowflake’s share price a major boost.

Strong cloud demand bodes well for Snowflake

Snowflake is a leading provider of data-warehousing services and related analytics and data management technologies. The company’s Data Cloud platform helps large businesses and organizations combine information that is generated across Amazon, Microsoft, and Alphabet‘s cloud infrastructure services. In turn, strong demand indicators for leading cloud infrastructure providers tend to bode well for Snowflake’s performance.

Amazon’s published its fourth-quarter report after the market closed yesterday. The results showed that the company’s sales had grown 14% year over year to reach $170 billion, coming in significantly ahead of the average analyst estimate for sales of $166.2 billion. Sales for the company’s Amazon Web Services (AWS) division rose 13% year over year to hit $24.2 billion.

Amazon’s strong Q4 report came on the heels of better-than-expected results from Microsoft earlier in the week. For the second quarter of its current fiscal year, which closed at the end of December 2023, Microsoft posted revenue of $62.02 billion and beat Wall Street’s call for sales of $61.12 billion in the period. The software giant’s revenue was up 18% year over year in the period, and sales for its Azure infrastructure business and other cloud services rose 30% year over year.

Is Snowflake stock a buy?

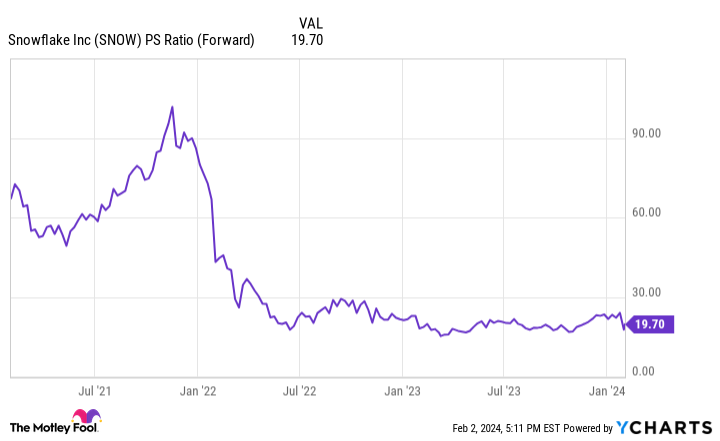

Snowflake stock has seen strong momentum in conjunction with excitement surrounding artificial intelligence (AI) and improving demand outlooks for key cloud businesses. On the one hand, the company’s share price still trades down roughly 46% from the peak that it reached in 2021.

Valued at roughly 20 times this year’s expected sales, Snowflake has a highly growth-dependent valuation. The company’s valuation profile means that its stock won’t be a great fit for every investor.

On the other hand, Snowflake is growing rapidly and is poised to continue playing an important role in the evolution of analytics and AI services. For risk-tolerant investors, the stock has the makings of a worthwhile portfolio addition, but you should weigh your personal tolerance for volatility before going in heavily on the stock.

Should you invest $1,000 in Snowflake right now?

Before you buy stock in Snowflake, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Snowflake wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 29, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, and Snowflake. The Motley Fool has a disclosure policy.

Why Snowflake Stock Soared Today was originally published by The Motley Fool